In the event your debts are paid by A further man or woman or are canceled by your creditors, you'll have to report element or all of this debt reduction as income. If you receive income in this manner, you constructively acquire the income once the personal debt is canceled or paid. To learn more, see

the subsequent make clear the general rule for together with canceled credit card debt in income as well as exceptions to the final rule.

If a financial loan payable to you becomes uncollectible in the course of the tax year and you use an accrual method of accounting, you frequently ought to include things like in gross income experienced stated interest accrued up to the time the financial loan turned uncollectible.

Examples of services which are normally delivered to maintain the plenty within a issue for tenant occupancy contain metropolis sewerage, electrical connections, and roadways.

Restricted property is residence that has specified limits that influence its value. If you get restricted stock or other house for services executed, the honest market place value of the home in excessive of one's Value is included in your income on Schedule C if the restriction is lifted.

you might be entitled to your deduction against the income if it compensates you for genuine economic damage. Your deduction could be the smaller of the subsequent amounts.

industrial clean up car or truck credit history. Businesses that obtain a certified commercial clean automobile may possibly qualify for your clear vehicle tax credit rating. See variety 8936 and its Guidelines To find out more.

you need to contain the fair market place value of any services you receive from club members within your gross receipts when you receive them even In case you have not offered any services to club customers.

you need to also file type 1099-NEC for All and sundry from whom you've got withheld any federal income tax (report in box four) underneath the backup withholding rules whatever the level of the payment.

it's possible you'll qualify for this credit history In case you have workforce and they are engaged in a business in an empowerment zone for which the credit score is available. For more info, see kind 8844.

for those who include things like an quantity in income As well as in a afterwards calendar year You need to repay all or A part of it, you can usually deduct the repayment inside the year in which you enable it to be. If the quantity you repay is around $three,000, a Unique rule applies. For aspects concerning the special rule, see

The online tax preparation software program partners are Portion of the free of charge File Alliance, which coordinates Together with the IRS to deliver no cost electronic federal tax preparation and submitting to you personally. This non-profit, public-personal partnership is devoted to supporting millions of people get ready and file their federal taxes online without spending a dime.

When you've got a money acquire or loss, it's essential to decide whether it is long-lasting or temporary. no get more info matter whether a gain or reduction is lengthy or temporary relies on how long you individual the house before you dispose of it. The time you very own property ahead of disposing of it can be known as the Keeping period of time.

Video meetings by using Zoom and group are a “excellent substitute” now due to the fact in-person meetings aren’t always attainable, Dula suggests.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Loni Anderson Then & Now!

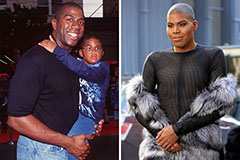

Loni Anderson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!